New USPTO Procedures for Discretionary Denials May Require New IPR and PGR Filing Strategies for Hatch-Waxman and BPCIA Cases

On March 26, 2025, Acting Director of the U.S. Patent & Trademark Office (USPTO), Coke Morgan Stewart, issued a memorandum creating a “bifurcated” approach for considering petitions for inter partes review (IPR) and post-grant review (PGR). Under this new approach, decisions concerning whether to institute IPR or PGR petitions will be bifurcated into two phases: (1) a preliminary consideration of the discretionary-denial factors and (2) if discretionary denial is not warranted, then a consideration of the merits and other nondiscretionary statutory factors. This bifurcated approach is meant to be temporary in nature and to help reduce the current workload of the PTAB.

Under this new approach, the Director will, in consultation with at least three Patent Trial & Appeal Board (PTAB) judges, determine whether discretionary denial of institution is appropriate. If the Director so determines, the Director will issue a decision denying institution. If not, the petition will be referred to a separate three-member panel of PTAB judges for a determination under standard operating procedures regarding whether institution is warranted. These procedures apply to all IPR and PGR proceedings in which the deadline for the patent owner to file a preliminary response has not yet passed.

New Briefing Schedule

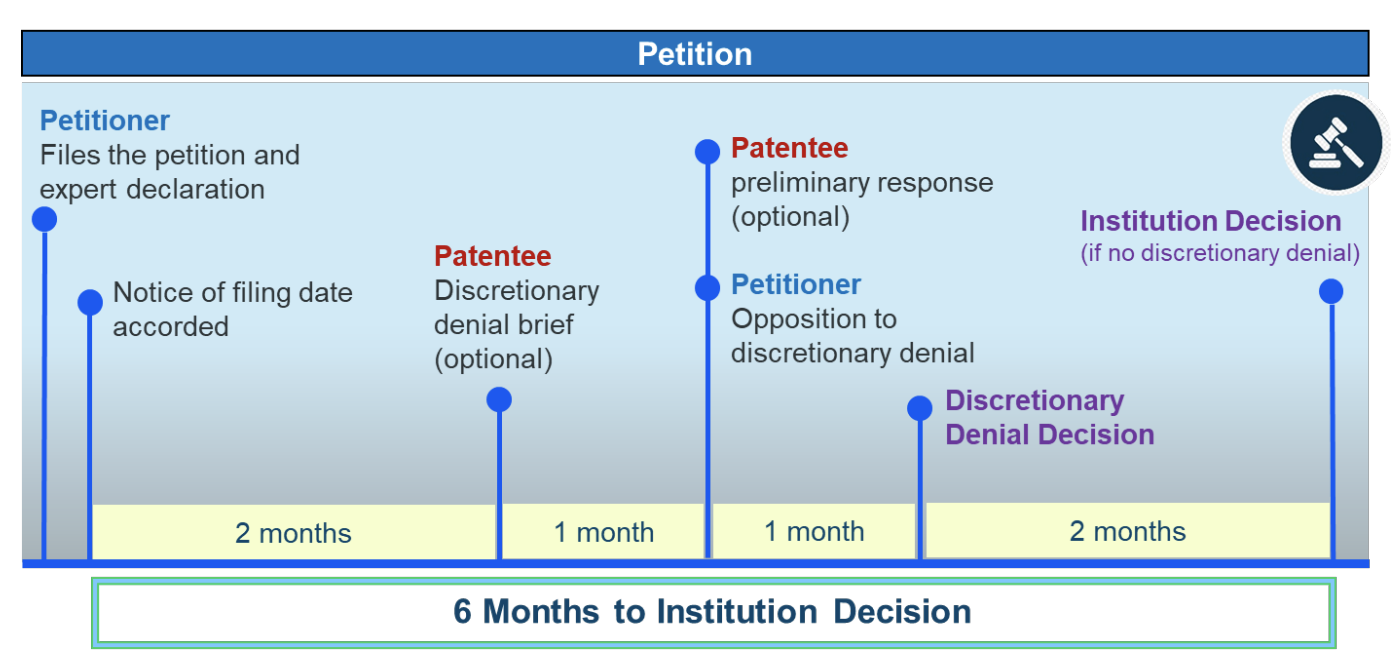

To facilitate this bifurcated approach, the USPTO will permit parties to file separate briefing on discretionary-denial requests. These new deadlines are indicated in the timeline below:

- Within 2 months of the date on which the PTAB enters a Notice of Filing Date Accorded to a petition, a patent owner may file a brief explaining any applicable bases for discretionary denial;

- A petitioner may file an opposition to the patent owner’s brief no later than 1 month after the patent owner files that brief; and

- Absent good cause, the Director will issue a decision on discretionary considerations within 1 month of the due date of the last relevant paper filed.

As noted above, the March 26 Memorandum indicated that the petitioner’s deadline was one month “after the patent owner files its brief” (Memorandum at 2), which suggested that, if the patent owner filed its brief more quickly, the petitioner’s opposition could be due before the patent owner’s preliminary response on the merits. That is, it appeared that the patent owner could “speed up” the discretionary review process by filing its brief early.

However, on April 25, 2025, the USPTO released a set of frequently asked questions (FAQ) about the new procedures. The FAQ clarified that the timing for a Petitioner to file an opposition brief “will not change if a patent owner files its discretionary denial brief early.” (FAQ, Availability and timing, No. 7) (emphasis added.)

This means that, as shown in the timeline above, the patent owner’s preliminary response on the merits (POPR) will be due on the same day as the petitioner’s opposition to the request for discretionary denial. Thus, the Director’s decision on the discretionary denial will not be issued until after the patent owner files its POPR (or the deadline for filing such response has passed). If there is a discretionary denial, no proceeding will be instituted. If the Director decides that discretionary denial is not appropriate, then a different PTAB panel will consider the petition on its merits and issue an institution decision.

Discretionary Denial Considerations

In their briefing regarding discretionary denial, the parties may address all relevant considerations set forth in prior PTAB decisions such as Fintiv (involving a parallel district court case), General Plastic (involving multiple IPR petitions), and Advanced Bionics (involving previous prior art presented before the USPTO). (See Memorandum at 2, citing cases.) These considerations include:

- Whether the PTAB or another forum has already adjudicated the validity or patentability of the challenged patent claims;

- Whether there have been changes in the law or new judicial precedent issued since issuance of the claims that may affect patentability;

- The strength of the unpatentability challenge;

- The extent of the petition’s reliance on expert testimony;

- Settled expectations of the parties, such as the length of time the claims have been in force;

- Compelling economic, public health, or national security interests; and

- Any other considerations bearing on the Director’s discretion.

The Memorandum indicates that the Director will also consider the ability of the PTAB to comply with pendency goals for ex parte appeals, its statutory deadlines for AIA proceedings, and other workload needs. (Memorandum at 3.).

Interplay with District Court Litigation

The creation of a bifurcated approach to institution, as well as the inadequacy of the PTAB’s current staffing to meet its workload, suggest that the USPTO will be much more likely to issue discretionary denials of IPR and PGR petitions than in the past.

In particular, in a March 24, 2025 memorandum, the USPTO rescinded its June 2022 interim guidance regarding Fintiv and the use of Sotera stipulations. Under that interim guidance, the PTAB indicated that it would not deny institution under Fintiv if a petitioner filed a stipulation agreeing not to pursue the same (or reasonably similar) grounds in a parallel proceeding, such as district court litigation. In such a litigation, the PTAB would also consider the median time-to-trial statistics in the particular district court involved, not just the scheduled trial date, which often gets delayed. The PTAB would weigh this factor against denying institution under Fintiv if the median time-to-trial is around the same time or after the projected statutory deadline for the PTAB’s final written decision.

Under the March 24 memorandum, the Board now considers any Sotera stipulation as part of its holistic analysis under Fintiv, not as a dispositive factor. Given that a Sotera stipulation is no longer sufficient to avoid discretionary denial, companies may want to reconsider their timing of IPR and PGR petitions to ensure that a PTAB proceeding will end well before any trial date in the district court, and focus their calculus on the actual trial date set by the court if available. To avoid discretionary denial, it may make sense to file petitions early in a litigation, well before the statutory one-year bar date and before a scheduling conference or trial date has been set.

In some cases, a company may want to file an IPR or PGR petition before a litigation starts, but at a time when the company will have standing to appeal any adverse IPR or PGR final determination, which requires concrete enough plans to establish a true case or controversy for appeal. For example, a generic applicant may want to file its petition around the time of a PIV notice letter in a Hatch-Waxman case. A biosimilar applicant may want to consider filing IPR or PGR long before the BPCIA “patent dance,” especially if the company intends to shorten the dance or provide a notice of commercial marketing in the early stages of the BPCIA dance. Whichever patent dance strategy it chooses to implement, a biosimilar applicant should consider timing a final determination to occur around the time it expects to get sued.

We look forward to working with our clients to develop interrelated IPR, PGR, and litigation strategies in Hatch-Waxman, BPCIA, and biotechnology patent cases in this evolving landscape.

The post New USPTO Procedures for Discretionary Denials May Require New IPR and PGR Filing Strategies for Hatch-Waxman and BPCIA Cases appeared first on Gemini Law.

]]>Lora Green speaks on Challenging Patents at the PTAB: Examining Policies, Procedures, and Practice Tips for PIV Practitioners, ACI PIV Conference, Day 2

For more information, visit: https://www.americanconference.com/paragraph-iv-disputes/agenda/

The post Lora Green speaks on Challenging Patents at the PTAB: Examining Policies, Procedures, and Practice Tips for PIV Practitioners, ACI PIV Conference, Day 2 appeared first on Gemini Law.

]]>Willkie IP Pros Join New York-Based Gemini Law, Rose Krebs, Law360 Pulse

New York-based intellectual property firm Gemini Law LLP has announced that it has added two former Willkie Farr & Gallagher LLP partners to enhance its capabilities to serve biotechnology, biopharmaceutical and more.

See more details:

https://www.law360.com/pulse/articles/2323987/willkie-ip-pros-join-new-york-based-gemini-law

The post Willkie IP Pros Join New York-Based Gemini Law, Rose Krebs, Law360 Pulse appeared first on Gemini Law.

]]>Gemini Law LLP Welcomes Former Willkie IP Partners Michael W. Johnson and Heather M. Schneider, Strengthening Patent Litigation Practice

Gemini Law, a leading provider of life sciences IP litigation and strategy, today announced the appointment of former Willkie Farr & Gallagher LLP partners Michael W. Johnson and Heather M. Schneider as partners effective April 1 and April 7, respectively.

Michael and Heather bring a wealth of trial experience to the Gemini team, having previously worked as partners at Willkie with a focus on patent litigation, counseling, and IP strategy. Michael was ranked among the leading practitioners in New York in Chambers USA 2024 in its Intellectual Property: Patent category and was recognized by IAM Patent 1000 as a top patent litigator in 2023 and 2024. Heather was also recognized by IAM Patent 1000 for patent litigation in 2024.

Michael and Heather have represented major life sciences companies in the district courts, PTAB, and appellate process, and will play a crucial role in growing Gemini’s patent litigation expertise for small-molecule and biosimilar drugs. They also have extensive experience working on IP strategy, opinion, and deal work, including diligence for complex patent portfolios.

“I am excited about joining Gemini to grow the Hatch-Waxman and BPCIA litigation practice. The Gemini business model allows us to provide world-class service while charging highly competitive rates for complex litigation,” said Michael. Heather added, “given Gemini’s innovative pricing model, we’ll be able to work as our client’s trusted advisor at every step of the product lifecycle, from inception to commercialization, opinion work to appeals.”

“Michael and Heather have been tremendously successful first-chair litigators at Willkie, where they led some of the most complex biopharma and biotech patent litigations in the industry. Adding their talent to our rapidly growing and deeply experienced Gemini team will allow us to significantly expand our capacity to serve our broad portfolio of international biotech, biopharma and med-tech clients,” said Robert Cerwinski, Managing Partner at Gemini.

About Gemini Law LLP:

Gemini is a new kind of life sciences law firm, providing a full range of IP services at a sensible cost. Our lawyers are among the most experienced and successful in the industry, having held leadership positions at prominent law firms, in-house legal departments, and the Patent Office. Gemini has helped manufacturers of biologics, smallmolecule drugs, bulk chemicals, medical devices and advanced materials around the world navigate IP barriers to access the U.S. market, all at a very sensible cost.

Contact:

Robert Cerwinski

Managing Partner

[email protected]

+1.917.915.8832

The post Gemini Law LLP Welcomes Former Willkie IP Partners Michael W. Johnson and Heather M. Schneider, Strengthening Patent Litigation Practice appeared first on Gemini Law.

]]>